The most common piggyback loan is the 80-10-10 the first mortgage is for 80 of the homes value a down payment of 10 is paid by the buyer and the other 10 is financed in a second trust loan at a higher interest rate. From stock market news to jobs and real estate it can all be found here.

First Time Homebuyer Programs In Michigan 2022

New American Funding is a mortgage lender offering a variety of home loan options to homebuyers and homeowners nationwide except for Hawaii.

. Best 51 ARM Loans Mortgage Rates Best Home Equity Loans Best Home Improvement Loans Best Home Improvement Loans for Bad Credit Reverse Mortgage. The company founded in 2003. No debt with middle-of-the-road credit.

Get breaking Finance news and the latest business articles from AOL. Essentially the buyer just puts 10 down and avoids paying PMI but may have higher interest rates. Good 690-719 After plugging in these numbers HomeLight estimates that you can afford a home that costs 282997 with monthly payments of 2100.

Amount of money for down costs.

The Absolute Cheapest State To Buy A House Is Cheap Houses Buying First Home House

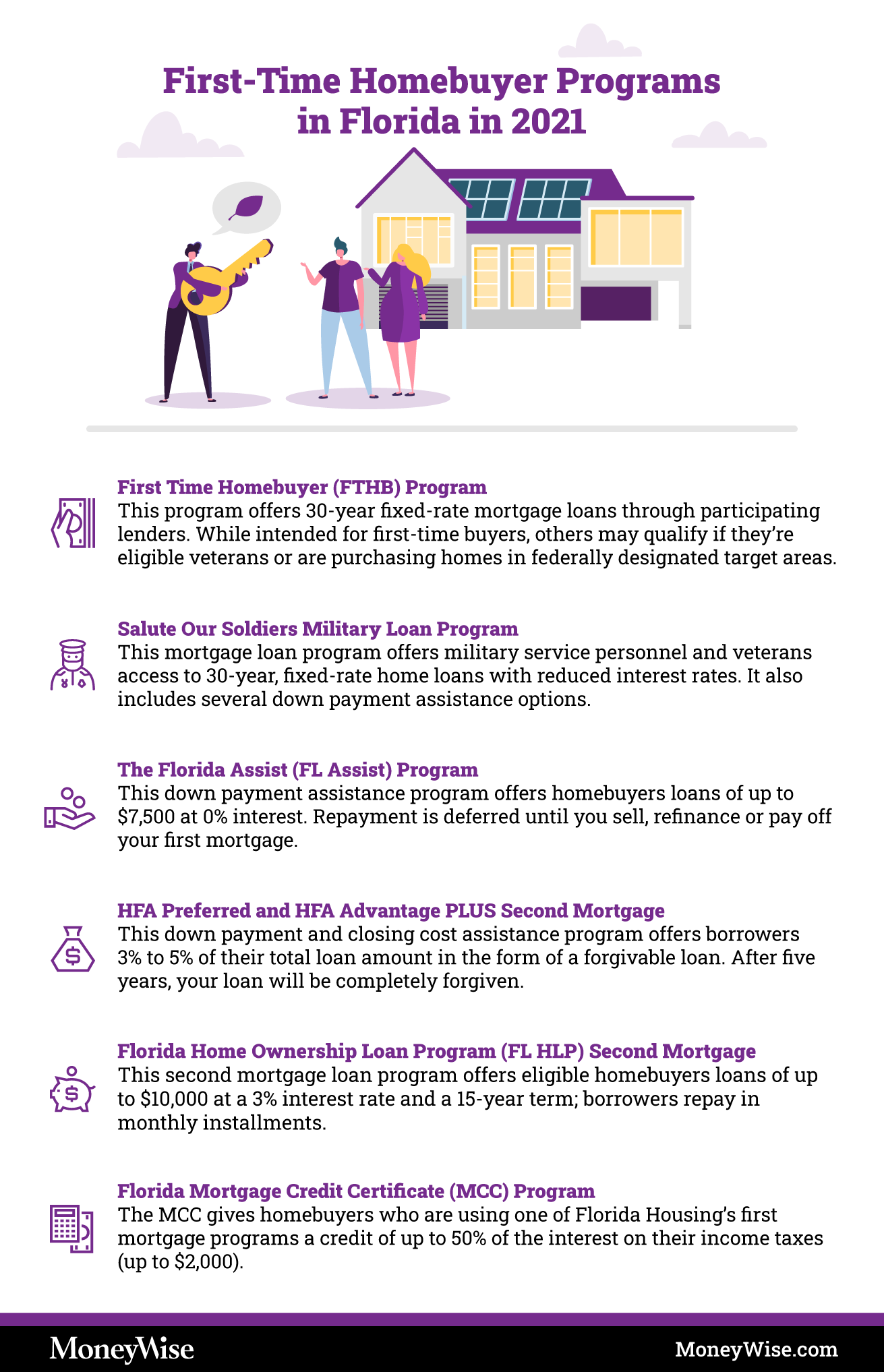

First Time Homebuyer Programs In Florida 2022

Minimum Credit Scores For Fha Loans

6 Steps For First Time Home Buyers First Time Home Buyers Home Buying Process Investment House

Tips For First Time Home Buyers What You Must Know Before You Buy

First Time Homebuyer Grants And Programs Nextadvisor With Time

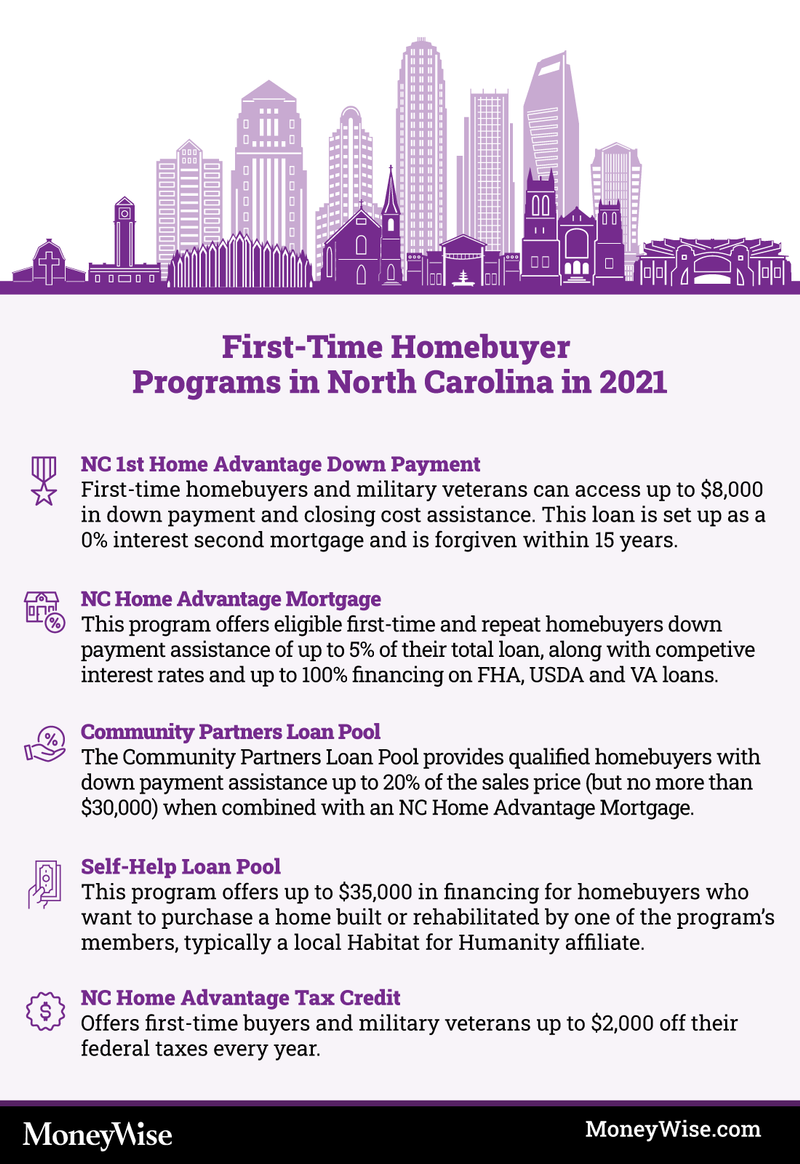

First Time Homebuyer Programs In North Carolina Nc 2022

Tips For First Time Home Buyers What You Must Know Before You Buy